“Strange days indeed, most peculiar Mama” – John Lennon Nobody Told Me – 1977

Surely Lennon would be adding new verses this month.

“Republicans on heroin. Lakota hold the line. Nazis in the bathroom, or in a White House slot. They overbuilt in China, so finish what you’ve got.”

And with recreational cannabis now legal in California, leading cities are putting on their green banker’s visors and getting ready to pass the proverbial peace pipe.

“… a Public Bank for Ganja, and I ain’t too surprised.”

The time has come to “Stash Your Cannabis Cash in Public Bank of Santa Rosa”. So writes Marc Armstrong, a founding member of the Transition Sonoma Valley Steering Team, in the North Bay Business Journal.

Armstrong also explained the opportunity in a recent KRCB North Bay Report (MP3, 3 minutes).

In theory — and throughout the rest of the world in practice — public banking has always made good sense. Local jurisdictions use public banks to diversify risk and increase local control over their financial assets.

But in the United States, most policy makers have low financial literacy, and as a result Wall Street banks dominate. The effort and time needed to start up a local public bank has always been considered a barrier.

However, because traditional banks are still prohibited by Federal law from serving the marijuana industry, the case for local public banks in California, Colorado, New Mexico, and elsewhere has suddenly gotten a whole lot more compelling.

Armstrong helped organize one of TSV’s first working groups in 2011 (the TSV Economic Study Group), and later went on to lead the nationwide Public Banking Institute and CommonomicsUSA.

After years of hard work all over the country, people are finally beginning to listen to Marc, author Ellen Brown, and others on the many benefits of banks when they are operated explicitly in the public interest.

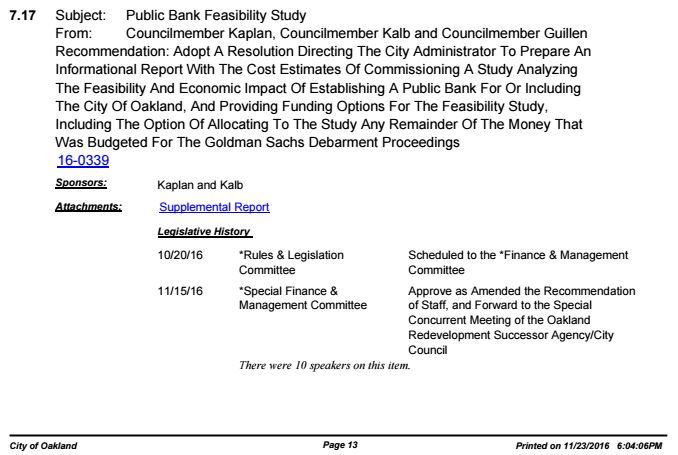

On November 15, 2016 a committee of the Oakland City Council voted unanimously to initiate a feasibility study on how to set up a city-wide or regional public bank, “including the option of allocating to the study the remainder of the money that was budgeted for the Goldman Sachs Debarment Proceedings”. Results of the study are expected toward the end of Q1 2017.

The sooner the better seems to be the attitude of the “unbanked” marijuana industry who see local public banks as a way to circumvent Federal prohibitions on processing their earnings.

Ten members of the public rose to speak in favor of the Oakland feasibility study, and no speakers were opposed. This video of that public hearing will be inspiring to anyone who remembers Marc, Jack Wagner, or author Ellen Brown speaking at a Transition SV or Praxis-Peace sponsored event in Sonoma when this was still just a twinkle in their eyes.

For a deeper dive into why public banking makes so much sense (when little else these days does), watch this excellent video of a recent conference in Santa Rosa on Cannabis Cash and Public Banking organized by Shelley Browning of Friends of Public Banking, featuring Armstrong, Brown, Figueroa, and others.

Nobody told me there’d be days like these.